Namibia just signed a recent bill to impose a tax on digital assets, cryptocurrencies, and virtual asset service providers (VASPs) in the country. This is a significant move proposed by the African Union on the budding and growing African industry.

The rise of platforms in Namibia such as African NFTs showcases its rich culture and untapped artistic potential. The platform is determined to provide a platform for Namibian artists to showcase their work and represent their country. The company now faces the imposed tax bill which will improve the artistic potential of the industry at large.

The new legislation aims to establish a framework for licensing and regulating virtual asset service providers (VASPs) operating within Namibia. By implementing a tax on digital assets, the government seeks to ensure proper oversight. In the same way, they create a regulated environment for their use and exchange.

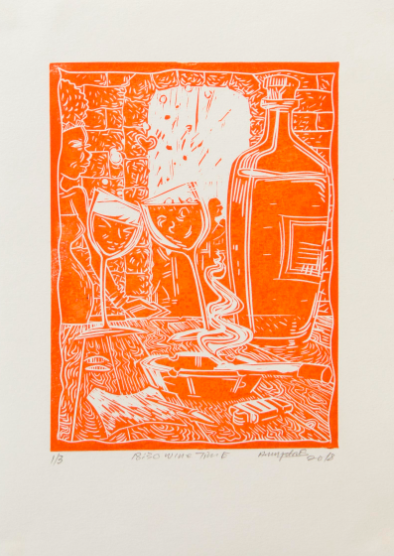

Medium: Linoleum block print on Fabriano paper. 295 x 210cm. Image courtesy of Start art gallery.

This development reflects Namibia’s recognition of the potential and growing importance of digital assets and cryptocurrencies in the global economy. By imposing a tax, the country aims to generate revenue while contributing to its economic growth. They also safeguard against potential risks such as money laundering and terrorist financing.

The tax on digital assets and cryptocurrencies will impact both individuals and businesses involved in the virtual asset ecosystem. VASPs, including cryptocurrency exchanges, wallets, and other digital asset service providers, will be subject to regulatory requirements and tax obligations.

The implementation of this tax underscores the government’s commitment to fostering a transparent and accountable financial ecosystem. By regulating the digital asset industry, Namibia aims to protect investors, promote market integrity, and create a level playing field for businesses operating in this space.

Furthermore, this move aligns with the broader trend across Africa, where countries are increasingly recognizing the potential of digital assets and cryptocurrencies. By embracing this emerging industry, nations can stimulate economic growth, foster innovation, and attract investments in the digital economy.

Namibia’s decision to impose a tax on digital assets and cryptocurrencies is a clear indication of the government’s proactive approach to adapting to the evolving financial landscape. It demonstrates their commitment to embracing technological advancements while ensuring that proper regulatory frameworks are in place to protect consumers and mitigate risks.

As the digital asset industry continues to evolve and mature, governments around the world are grappling with the need to develop robust regulatory frameworks. Namibia’s move sets an example for other African nations, encouraging them to adopt similar measures to support the growth and development of the digital asset industry.

In conclusion, Namibia’s recent bill to impose a tax on digital assets and cryptocurrencies represents a significant step in regulating and harnessing the potential of this emerging industry. By creating a regulatory framework and imposing tax obligations, the country aims to ensure a secure and transparent environment for the use and exchange of digital assets while stimulating economic growth. This move aligns with the broader trend in Africa and sets a precedent for other nations to embrace and regulate the digital asset industry effectively.