It’s common knowledge that the world is currently facing an economic downturn due to the pandemic and the recent Ukraine-Russian war. Major art companies like Artsy have been forced to lay off numerous employees, indicating a clear economic depression. Art, being a unique asset, requires a strategic plan for handling it during these challenging times.

First and foremost, it’s important to note that the current inflation rate in Africa stands at 6.9%. Although Africa has made progress compared to previous years, the inflation rate remains alarmingly high. The pandemic significantly destabilized the economy, causing various industries to come to a standstill. However, the arts industry managed to weather the storm and survive this economic surge.

Nonetheless, our volatile industry did not escape unscathed. While more artists are now able to sustain themselves through their art, there is still much work to be done. Achieving creative sustainability is a gradual process, especially in today’s economically unstable climate. Therefore, it’s crucial to examine why it’s safe to hold onto your art in the current circumstances.

Demand

One compelling reason is the increase in demand. In the art industry, demand and supply are the most valuable factors. The global economy is currently highly volatile, and people are increasingly seeking intimate and personal experiences. The COVID-19 pandemic emphasized the need for such experiences, resulting in a shift towards more intimate events. Consumers are now willing to pay more for intimate events featuring professional artists. This trend should be noted by art enthusiasts, particularly those in Africa.

Capital gains

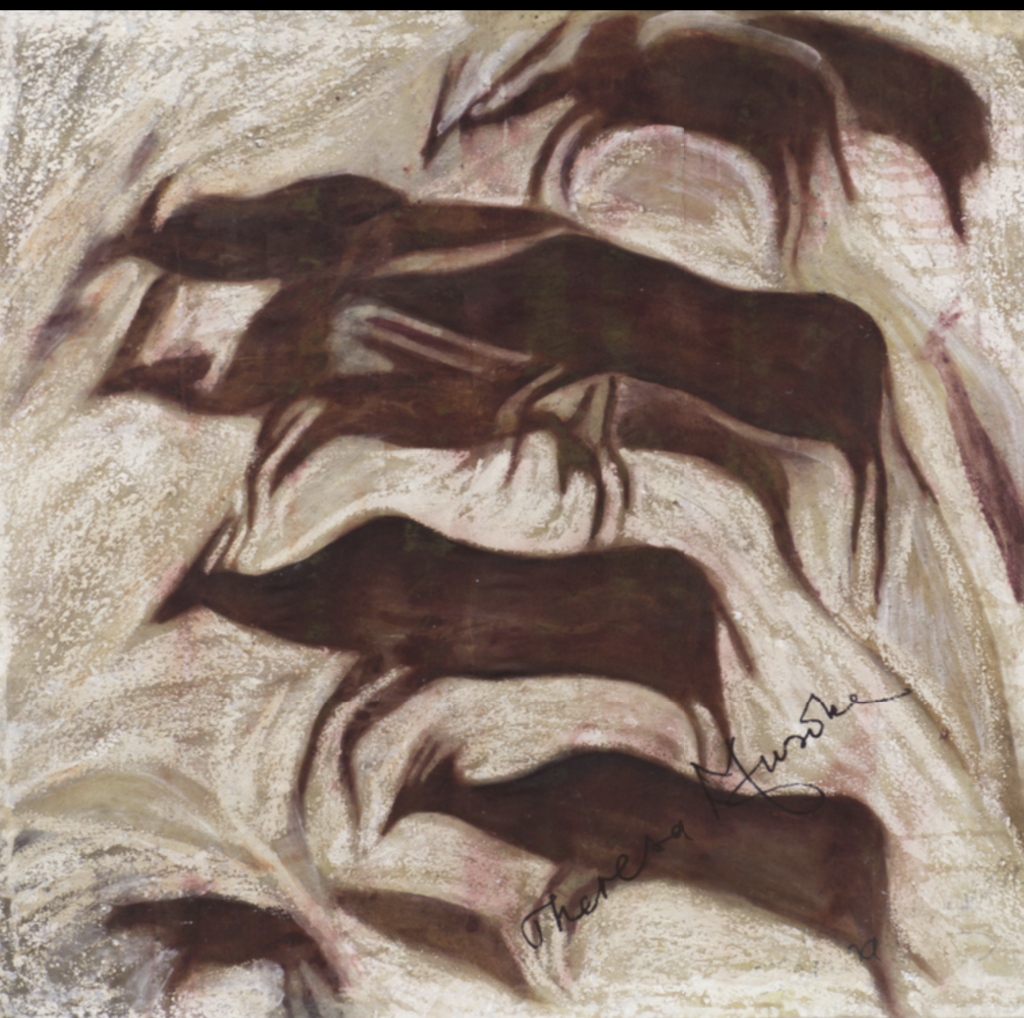

Another reason to hold onto your art is the potential for capital gains. Art can be considered an investment, with individuals gaining capital from art pieces or stocks. Fractionalization or tokenization has become a popular option for investors, enabling them to purchase a fraction of valuable art pieces for as low as $100. In African countries, this amounts to just a few thousand shillings. Art assets have the potential to increase in value, offering a good return on investment. Purchasing the works of artists like Theresa Musoke and Ancient Soi in 2023 could result in their art pieces being worth twice as much in the next year.

Portfolio Diversification

Furthermore, diversifying your earnings is crucial for improving your investment portfolio. Including ancient African art in your collection diversifies your earnings and reduces your risk during an economic recession. By holding valuable art, you increase your chances of making a profit from multiple sources of investment. Investing in traditional 15th-16th century African art is a way to leverage this strategy, as it has performed well in recent Sotheby’s art auctions.

Although this example provides only a glimpse into the importance of holding onto your art today, it additionally highlights the potential for avoiding risks associated with the African art market. For more information on investment opportunities in the African art industry, click here.